Is Equipment Purchase An Expense . When equipment is purchased, it appears on the income statement as a depreciation charge. In the context of companies that sell merchandise, the term purchases refers to the purchases of goods that. Equipment can be recorded as fixed assets, for these are the items that you can't immediately count as an expense when purchased. Rather the expense is spread out over the life of the equipment. When you purchase the equipment, all entries made to account for the purchase appear on. The purchase of equipment is not accounted for as an expense in one year; If the amount is small, it is. Record the initial purchase on the date of purchase, which places the asset on the balance sheet (as property, plant, and equipment) at.

from www.chegg.com

In the context of companies that sell merchandise, the term purchases refers to the purchases of goods that. If the amount is small, it is. Rather the expense is spread out over the life of the equipment. The purchase of equipment is not accounted for as an expense in one year; Equipment can be recorded as fixed assets, for these are the items that you can't immediately count as an expense when purchased. When equipment is purchased, it appears on the income statement as a depreciation charge. When you purchase the equipment, all entries made to account for the purchase appear on. Record the initial purchase on the date of purchase, which places the asset on the balance sheet (as property, plant, and equipment) at.

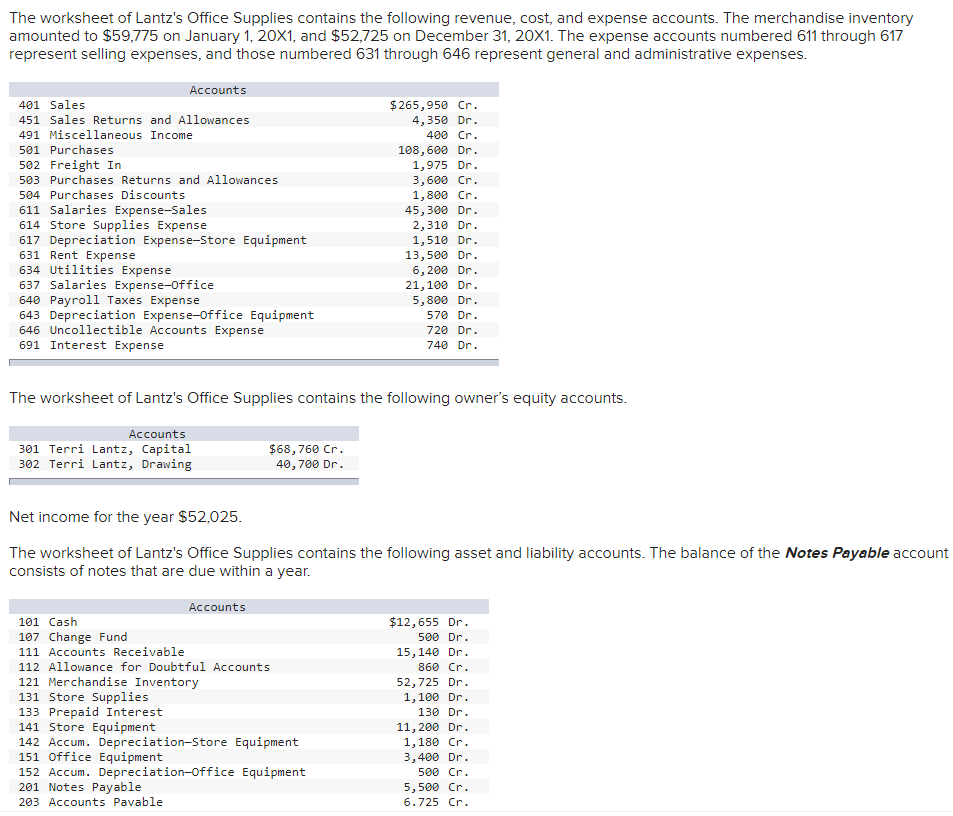

Solved The worksheet of Lantz's Office Supplies contains the

Is Equipment Purchase An Expense Rather the expense is spread out over the life of the equipment. Rather the expense is spread out over the life of the equipment. Equipment can be recorded as fixed assets, for these are the items that you can't immediately count as an expense when purchased. When you purchase the equipment, all entries made to account for the purchase appear on. If the amount is small, it is. In the context of companies that sell merchandise, the term purchases refers to the purchases of goods that. The purchase of equipment is not accounted for as an expense in one year; Record the initial purchase on the date of purchase, which places the asset on the balance sheet (as property, plant, and equipment) at. When equipment is purchased, it appears on the income statement as a depreciation charge.

From www.chegg.com

Solved The worksheet of Lantz's Office Supplies contains the Is Equipment Purchase An Expense Record the initial purchase on the date of purchase, which places the asset on the balance sheet (as property, plant, and equipment) at. When you purchase the equipment, all entries made to account for the purchase appear on. Equipment can be recorded as fixed assets, for these are the items that you can't immediately count as an expense when purchased.. Is Equipment Purchase An Expense.

From www.superfastcpa.com

What is Office Equipment Expense? Is Equipment Purchase An Expense Rather the expense is spread out over the life of the equipment. Equipment can be recorded as fixed assets, for these are the items that you can't immediately count as an expense when purchased. If the amount is small, it is. When equipment is purchased, it appears on the income statement as a depreciation charge. Record the initial purchase on. Is Equipment Purchase An Expense.

From www.coursehero.com

[Solved] Please answer question fully. On April 1, Cyclone Company Is Equipment Purchase An Expense The purchase of equipment is not accounted for as an expense in one year; Rather the expense is spread out over the life of the equipment. In the context of companies that sell merchandise, the term purchases refers to the purchases of goods that. When equipment is purchased, it appears on the income statement as a depreciation charge. When you. Is Equipment Purchase An Expense.

From jennifercgreenxo.blob.core.windows.net

Journal Entries For Cost Of Goods Sold Is Equipment Purchase An Expense In the context of companies that sell merchandise, the term purchases refers to the purchases of goods that. When equipment is purchased, it appears on the income statement as a depreciation charge. Equipment can be recorded as fixed assets, for these are the items that you can't immediately count as an expense when purchased. The purchase of equipment is not. Is Equipment Purchase An Expense.

From db-excel.com

Vending Machine Spreadsheet for Vending Machine Inventory Spreadsheet Is Equipment Purchase An Expense In the context of companies that sell merchandise, the term purchases refers to the purchases of goods that. Rather the expense is spread out over the life of the equipment. Equipment can be recorded as fixed assets, for these are the items that you can't immediately count as an expense when purchased. When you purchase the equipment, all entries made. Is Equipment Purchase An Expense.

From www.chegg.com

Solved Tesla management are trying to decide whether to keep Is Equipment Purchase An Expense In the context of companies that sell merchandise, the term purchases refers to the purchases of goods that. The purchase of equipment is not accounted for as an expense in one year; If the amount is small, it is. Rather the expense is spread out over the life of the equipment. Record the initial purchase on the date of purchase,. Is Equipment Purchase An Expense.

From www.chegg.com

Solved Orion Flour Mills purchased a new machine and made Is Equipment Purchase An Expense Rather the expense is spread out over the life of the equipment. If the amount is small, it is. The purchase of equipment is not accounted for as an expense in one year; Record the initial purchase on the date of purchase, which places the asset on the balance sheet (as property, plant, and equipment) at. When you purchase the. Is Equipment Purchase An Expense.

From www.chegg.com

Solved The following financial statements and additional Is Equipment Purchase An Expense Equipment can be recorded as fixed assets, for these are the items that you can't immediately count as an expense when purchased. In the context of companies that sell merchandise, the term purchases refers to the purchases of goods that. When you purchase the equipment, all entries made to account for the purchase appear on. Record the initial purchase on. Is Equipment Purchase An Expense.

From www.superfastcpa.com

What is Equipment Rental Expense? Is Equipment Purchase An Expense If the amount is small, it is. When you purchase the equipment, all entries made to account for the purchase appear on. Equipment can be recorded as fixed assets, for these are the items that you can't immediately count as an expense when purchased. When equipment is purchased, it appears on the income statement as a depreciation charge. The purchase. Is Equipment Purchase An Expense.

From www.chegg.com

Solved 2 Accounts Receivable Accumulated Depreciation Is Equipment Purchase An Expense If the amount is small, it is. In the context of companies that sell merchandise, the term purchases refers to the purchases of goods that. Rather the expense is spread out over the life of the equipment. Record the initial purchase on the date of purchase, which places the asset on the balance sheet (as property, plant, and equipment) at.. Is Equipment Purchase An Expense.

From www.stampli.com

How to Take Control of T&E Expenses Is Equipment Purchase An Expense In the context of companies that sell merchandise, the term purchases refers to the purchases of goods that. The purchase of equipment is not accounted for as an expense in one year; If the amount is small, it is. Equipment can be recorded as fixed assets, for these are the items that you can't immediately count as an expense when. Is Equipment Purchase An Expense.

From www.template.net

44+ Expense Sheet Templates in PDF Is Equipment Purchase An Expense Equipment can be recorded as fixed assets, for these are the items that you can't immediately count as an expense when purchased. When equipment is purchased, it appears on the income statement as a depreciation charge. Record the initial purchase on the date of purchase, which places the asset on the balance sheet (as property, plant, and equipment) at. If. Is Equipment Purchase An Expense.

From kayden-chapter.blogspot.com

When Forecasting Cash Disbursements In The Cash Budget 83+ Pages Is Equipment Purchase An Expense Rather the expense is spread out over the life of the equipment. When equipment is purchased, it appears on the income statement as a depreciation charge. The purchase of equipment is not accounted for as an expense in one year; If the amount is small, it is. In the context of companies that sell merchandise, the term purchases refers to. Is Equipment Purchase An Expense.

From www.coursehero.com

[Solved] show the steps Budgeted Statement and Supporting Is Equipment Purchase An Expense When you purchase the equipment, all entries made to account for the purchase appear on. If the amount is small, it is. Record the initial purchase on the date of purchase, which places the asset on the balance sheet (as property, plant, and equipment) at. Equipment can be recorded as fixed assets, for these are the items that you can't. Is Equipment Purchase An Expense.

From www.chegg.com

Solved Gain on sale of equipment Office supplies expense Is Equipment Purchase An Expense If the amount is small, it is. Rather the expense is spread out over the life of the equipment. When you purchase the equipment, all entries made to account for the purchase appear on. Record the initial purchase on the date of purchase, which places the asset on the balance sheet (as property, plant, and equipment) at. Equipment can be. Is Equipment Purchase An Expense.

From www.chegg.com

Solved The worksheet of Lantz's Office Supplies contains the Is Equipment Purchase An Expense Record the initial purchase on the date of purchase, which places the asset on the balance sheet (as property, plant, and equipment) at. Rather the expense is spread out over the life of the equipment. When you purchase the equipment, all entries made to account for the purchase appear on. The purchase of equipment is not accounted for as an. Is Equipment Purchase An Expense.

From www.chegg.com

Solved B2B Company is considering the purchase of equipment Is Equipment Purchase An Expense The purchase of equipment is not accounted for as an expense in one year; When equipment is purchased, it appears on the income statement as a depreciation charge. When you purchase the equipment, all entries made to account for the purchase appear on. Record the initial purchase on the date of purchase, which places the asset on the balance sheet. Is Equipment Purchase An Expense.

From wizedu.com

Beech Corporation is a merchandising company that is preparing a master Is Equipment Purchase An Expense Rather the expense is spread out over the life of the equipment. Record the initial purchase on the date of purchase, which places the asset on the balance sheet (as property, plant, and equipment) at. When equipment is purchased, it appears on the income statement as a depreciation charge. In the context of companies that sell merchandise, the term purchases. Is Equipment Purchase An Expense.